how to calculate loan interest

2 lakhs through a simple process with minimal. One use of the RATE function is to calculate the periodic interest rate when the amount number of payment periods and payment amount are known.

Excel Tip Calculating Interest Accountingweb

How To Calculate Mortgage Insurance On An Fha Loan Related Articles.

. To calculate your student loan payments enter the loan amount anticipated interest rate and lengthterm of the loan how many years you have to pay it back. Pv - The present value or total value of all payments now 5000 from cell C5. The RATE function is used like this.

For example you have borrowed 100000 from bank in total the annual loan interest rate is 520 and you will pay the bank every month in the coming 3 years as below screenshot shown. Now you can calculate the total interest you will pay on the. If the rate is advertised as 3 per year but the loan is only six months then you would calculate a 3 annual interest rate for a term of 05 years.

To calculate the amount of student loan interest that accrues monthly find your daily interest rate and multiply it by the number of days since your last payment. Calculate car loan interest payment on your own To start find the amount interest rate and the term of your auto loan. Start_period - the first period of interest 1 in this case since we are calculating principal across the entire loan term.

R rate of interest per month annual rate of interest divided by 12 n tenure in months For example if any borrower avails a loan of 40 lakh for a tenure of 10 years at a 680 pa. Put your preferred loan amount interest rate processing fee and tenure into the form. Loan APR which is expressed as a yearly percentage rate represents the true cost of your loan after taking into account the loan interest rate plus the fees charges that you pay when getting a loan.

Calculate total interest paid on a loan in Excel. Apply for housing loan now. The loan calculator would help you calculate EMI interest cost and total amount payable against various loan amounts interest rates and loan tenures in no time.

End_period - the last period of interest 60 in this case for the full loan term. How to calculate interest rates Most personal loans are amortized with a fixed interest rate expressed as an APR. Note that most lenders do not approve personal loan application if the overall EMI.

Tata Capital Housing Loan EMI Calculator offers easy home loan process to get your EMI amount instantly. Figuring out how lenders charge interest for a given billing cycle is actually fairly simple. Technically you can use car loan payment calculators on any of your loans.

The monthly payment for your personal loan depends on various factors such as the loan amount interest rates and. The calculator will tell you the average monthly payment and calculate the total interest paid over the term of the loan. The easiest way to calculate total interest paid on a car loan is by using an online amortization calculator.

The Gold Loan interest rate calculator employs a mathematical formula to determine the interest rates youll be paying on the loan against gold. You can also view the details of your payment plan through an amortisation chart. It gives you the offered rate of interest and loan tenure.

These variables help you plan ways to reduce your debt. Then multiply that by your loan. By contrast the annual percentage rate APR is a way of expressing the total cost of borrowing.

Interest is the price you pay to borrow money. Click Calculate to see your estimated monthly payment. Heres how to calculate loan interest.

Rate of interest the applicable EMI will be. Tata Capital provides easy Microfinance Loans available at attractive interest rates. An amortized loan means the lender works out a schedule of repayment where the monthly payment amount stays the same but the interest is based on the unpaid principal balance at the beginning of the month.

Add up the total interest paid over the life of the loan in cell E5 by entering the following formula without quotation marks. Though you can use our Gold Loan calculator to calculate the EMI you will require to submit a certain documents availing a gold loan on. The fee can be paid in cash or financed.

Input the principal amount of the loan the period of the loan in months or years and the interest rate of the loan. Some loan calculators allow you to check how increasing your monthly payment affects how fast you can pay your loan off. Get Home Loan Interest rates online at 715.

For example lets take a 100 loan which carries a 10 compounded interest. As you move towards the end of your loan a large portion of your payment is directed towards the principal loan amount than the Interest cost. If you wish to calculate your Interest cost for an Amortizing loan then you can use the following method.

Generally the longer the term the more interest will be accrued over time raising the total cost of the loan for borrowers but reducing the periodic payments. Knowing EMI in advance would also help you plan your finances before taking a personal loan. In this step we must add the Amount Financed E1 - this may seem counterintuitive but because Excel correctly treats our calculated Payment as a cash outflow and assigns it a negative value we must add back the Amount.

Learn more about the home loan rates processing fee and other chargers with Tata Capital. For existing Sallie Mae loans entering principal and interest repayment. If you take out a 20000 personal loan you may wind up paying the lender a total of.

What is loan interest. Calculate total interest paid on a loan in Excel. Nper - the total number of payment periods for the loan 60 from cell C8.

As you come close to paying off your loan the situation takes a reverse turn. FHA Programs for Teachers. 3 Steps to Calculate Your Student Loan Interest.

As long as you know your loan factors the calculator will work. The term of the loan can affect the structure of the loan in many ways. A loan term is the duration of the loan given that required minimum payments are made each month.

All you have to do is follow these three steps. After one year you have 100 in principal and 10 in interest for a total base of 110. The fee ranges from 125 percent to 33 percent of the loan amount depending on the borrowers category of military service down payment percentage and whether the loan is the borrowers first VA loan.

Loan APR is a more complete measure that reflects the net effective cost of your loan on a yearly basis. The interest rate is the amount that the lender actually charges you as a percent of your loan amount. Use Home Loan EMI Calculator to calculate your home loan EMI.

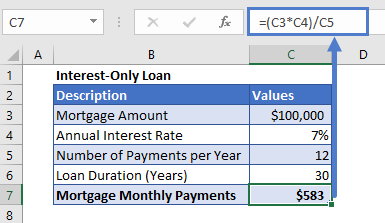

In this example we want to calculate the annual interest rate for 5-year 5000 loan and with monthly payments of 9322. Avail a loan up to Rs. The term may be anywhere from 24 months to 84 months but the longer you.

As another example if the rate is agreed to be 1 per month and you borrow the money for six months then the term for calculation would be 6. When you apply for a.

Loan Interest Calculator How Much Will I Pay In Interest

Time Value Of Money Board Of Equalization

How To Calculate Loan Interest Bankrate

How To Calculate Effective Interest Rate And Discount Rate Using Excel Toughnickel

Is There A Way To Calculate Student Loan Payments If Interest Rates Or Amount Are Lower Quora

How To Calculate Interest On A Loan Payment In Ms Excel 2007 Microsoft Office Wonderhowto

Alteryx For Excel Users Calculating Loan Installments And Amortization Schedules Alteryx Community

What Is A Factor Rate And How Do You Calculate It

Home Loan Interest Calculator Hotsell 60 Off Ilikepinga Com

Margill How To Calculate Loans

How To Calculate Home Loan Interest In Excel 2 Easy Ways Exceldemy

Interest Expense Formula Calculator Excel Template

Interest Only Mortgage Calculator

Math Monday Solving Equations And Loans Blog

Using Rate Function In Excel To Calculate Interest Rate

How To Calculate A Loan Payment Interest Or Term In Excel

Comments

Post a Comment